Mind The Gap: Addressing The Finance And Accounting Talent Gap In 2025

Artificial Intelligence (AI) and machine learning are also becoming increasingly important, transforming the way bookkeepers analyze data and generate insights. These technologies enable the identification of financial trends and provide predictive analytics, which can help businesses in decision-making processes. Effective payroll management is a critical function for any business, ensuring employees are paid accurately and on time. Bookkeepers and payroll processors play essential roles in handling these financial responsibilities. Outsourced bookkeeping services equip businesses with precise data for actionable insights through thorough reports.

- Our Dallas campus’s location offers easy access to the surrounding cafes and restaurants, grocery stores, and clothing outlets.

- The retail sector, healthcare industry, and manufacturing are highly reliant on professional bookkeepers.

- They must verify that the provider follows recognized accounting standards and maintains a high level of data protection.

- The NACPB offers a certified public bookkeeper (CPB) certification, while the CPB offers a certified bookkeeper (CB) certification.

- Key factors include the complexity of financial transactions, the level of scrutiny from tax authorities, and the necessity for precise financial data to inform business strategy and operations.

Bookkeeping Outsourcing Trends and Future Outlook

The catering and hospitality sector outsources bookkeeping to handle event-based bookkeeping, tipping allocations, and day-to-day revenue tracking. External bookkeeping services can streamline financial operations during variable turnover periods. It involves keeping track of financial transactions, recording expenses, and ensuring that the business’s finances are in order. While every business needs bookkeeping to some degree, some businesses require it more than others.

What are the implications of not having a professional bookkeeper in a small business?

These foundational services are critical for the accurate and efficient operation of a company’s finances. Building a reservoir of industry-specific knowledge and experience is crucial for bookkeepers to offer more informed services. Gaining this expertise typically involves several years of hands-on work and a proactive approach to learning the subtleties of the chosen field. Law firms handle numerous trust accounts and require precise bookkeeping to ensure compliance with legal standards. Offering specialized bookkeeping services to this sector allows experts to cater to a niche where accuracy Bookkeeping for Painters is paramount, reducing competition and increasing profitability. Selecting a bookkeeping niche involves focusing one’s expertise and services to cater to a specific industry or field.

Best Practices for Managing an Outsourced Bookkeeping Team

Retail stores in Melbourne are always brimming with customers and have to keep track of a high volume of sales. Besides the daily transactions, these ventures have to manage their inventory, payroll, expenses, and taxes. Stock management is a vital aspect of running a retail business because the sale of its products depends on it. With the right virtual team of healthcare bookkeepers in place, managing day-to-day transactions become quite easy.

What is bookkeeping subject?

- Encryption is a standard practice, ensuring that financial data is protected from unauthorized access during transfer and storage.

- Financial Management EnhancementSmall businesses that outsource bookkeeping can expect a reduction in errors, thanks to the expertise of seasoned professionals.

- This shift helps small businesses conserve energy and time, which can be channeled into areas that directly contribute to business development.

- E-commerce businesses need accurate bookkeeping and accounting services to manage transactions, track inventory, keep an eye on the cash flow, and optimize their financial operations.

- With the advancement of technology, preserving data security and ensuring privacy have become paramount in bookkeeping.

- Accounting for educational institutions in Melbourne can be daunting without the help of professionals.

- In a desperate bid to fill these widening gaps, many organizations are hiring less qualified or even unqualified candidates without accounting degrees and investing heavily in training.

Companies must tailor their record-keeping practices to support their unique accounting requirements while ensuring compliance with tax Bookkeeping for Any Business Industry laws. Ultimately, successful cash flow management aids in making pivotal decisions that direct a company towards sustainable growth and stability. Outsourced bookkeeping provides concrete benefits tailored to the unique demands of various industries. By leveraging external expertise, businesses can streamline operations and enhance financial clarity.

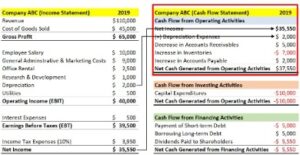

Preparation of Financial Statements and Reports

The accounting industry continually evolves, offering new accounting niches and opportunities for bookkeepers to specialize in areas that promise growth and profitability. Certification programs are fundamental in affirming one’s commitment and competence in a bookkeeping niche. Further, bookkeepers should engage in continuing education to stay current with industry-specific regulations and practices. It not only supports meticulous record-keeping but also underpins strategic decisions that drive business growth. This method increases the accuracy of the financial records by ensuring that the ledger is always balanced, making it a cornerstone of robust bookkeeping practices. Single-entry bookkeeping is a simple system that records each financial transaction as a single entry in a ledger.